- Home

- Knowledge Center

It is a unique 10 digit alpha-numeric identity allotted to each tax payer. PAN eryc Permanent Account Number(LFkk;h [kkrk la[;k) ;g Bank [kkrk [kksyus ds fy, Hkh tjQjh gS† vkidh income ij correct rate ls TDS dkVus ds fy,PAN vR;ar vko';d gS† fdlh Hkh izdkj dh laiRrh ds [kjsnh ;k fcfdz ds fy, tjQjh gS† lHkh financial O;ogkj ( foRrh; ysunsu) ds fy, egRoiw.kZ gS†

Q. PAN cukus ds fy, dkSu ls documents dh vko';drk gS ?

A. 2 Photos, ID Proof, Date of Birth Proof vkSj Address Proof.

Q. bls cukus esa fdruk [kpkZ vkSj le; yxrk gS ?

A. PAN cukus ds fy, 110$& jQ Government Fees yxrh gS† ge PAN Application ds fy, dksbZ charge ugh ysrs PAN Application ds ckn dqN gh fnuksa esa PAN cuds vkids ?kj Income Tax Department Onkjk deliver fd;k tkrk gS†

Q- Income Tax Return D;k gS ?

A- Income Tax Return iQkbZy djuk eryc vkids income dk C;ksjk laf{kIr jQi es ljdkj dks nsuk gS†

Q- Income Tax Return dkSu iQkbZy dj ldrs gS ?

A- NksVs& cMs lHkh izdkj ds O;kikjh contractors, services iznku djus okys] ukSdjh djus okys government, private ,oa vxj vkidks dgh ls Hkh dqN Hkh income izkIr gksrh gS rks vki Income Tax Return iQkbZy dj ldrs gS†

yksx D;k dgrs gS %& Income Tax Return Hkjus ds fy, eq>ks Accounting, Return dk [kpkZ ,oa Tax Hkjuk iMsxk†

lp D;k gS%& vxj vkidk turnover 2 crore ls de gS rks section 44 AD ds rgr vki 8% Net Profit (6% for cashless transaction) fn[kkdj ;s lHkh [kpsZ de dj ldrs gS† D;ksadh vkidks Account book maintain djus dh tjQjr ugh gS† bl ,d simple return ds lkFk vki Income Tax Return Hkjus okys lUekufu; ukxjhd cu ldrs gS†

yksx D;k dgrs gS%& vxj dksbZ Hkh property iDds ds iSlks esa cspsaxs rks 20% capital gain tax yxsxk ?

lp D;k gS %& Income Tax Act ds rgr Indexation, Cost of Improvement [kpsZ Investment,Slh dbZ fpts gS ftuds dkj.k vki O;ofLFkr Tax planning djds iDds ds Deal es Hkh Nil tax ;k de Tax es iDds dk lksSnk dj ldrs gS†

yksx D;k dgrs gS %& esjs ikl vxj ,d ?kj gS vkSj eS nqljk ?kj Bank Loan ls [kfjnqqaxk rks eq>ks D;k Tax es dksbZ benefit feysxk† ?

lp D;k gS %& Income Tax ds Section 24 rgr] nqljs ?kj [kjhnus ds fy, yxk iqjk O;kt Taxable Income esa ls de fd;k tk ldrk gS† rFkk 30% deduction, House Tax ;s lkjs [kpsZ Hkh allowed gS† ,d vPNs Tax Planning ds lkFk vki Rental Income dekuk Hkh pkyq dj ldrs gS†

Business djrs oDr tks tks [kpsZ vkids gksrs gS og lkjs [kpsZ vkidks Allowed gksaxs- Hkys gh ml [kpksz ds fcy ;k Receipt vkids ikl gks ;k u gks†

Loan/Fiance ikus ds fy, tjQjh T;knk Income fn[kkus ds ckotqn Hkh dk;ns ds nk;js es jgdj Depreciation, Deduction, Investment ,oaa ,Sls dkiQh rjhdks ls Tax Planning ds rgr Tax cpk;k tk ldrk gS†

Q. 80 C ds varxZr fdruk benefits feyrk gS†

A. vxj vkius Insurance premieum (LIC) cPpksa dh School fees, mutual fund, PF, PPF es Hkqxrku fd;k gS rks /kkjk 80 C ds varxZr 1.5 yk[k jQ- rd Tax es NqV fey ldrh gS†

Q. NPS (National Pension Scheme) es deposit djus ls D;k iQk;nk gksxk†

A. NPS es deposite djus ls additional deposite upto Rs. 50,000 (above 1.5 lakh under section 80C) rd NqV feyrh gS under section 80CCD

Q. D;k fdjk;s dk ?kj dk dqN iQk;nk feyrk gS Tax es†

A. fdjk;s ds ?kj dk iQk;nk Business Return es /kkjk 80 GG ds rgr Rs. 50,000 rd feyrk gS†

Q. D;k nku nsus ls tax benefit feyrk gS†

A. vxj vkius fdlh /kEkZnk; laLFkk es donation ;k ns.kxh dk Hkqxrku fd;k gS rks vkidks /kkjk 80G rs rgr tax esa NqV feyrh gS†

Q. D;k Mediclaim ij Hkh tax benfit feyrk gS†

A. /kkjk 80D ds rgr vkids mediclaim ij Rs. 50,000 rd NqV feyrh gS†

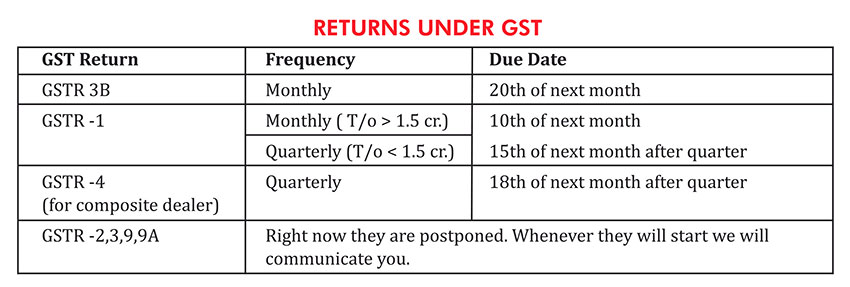

,d ns'k ,d tax ;s concept is GST yk;k x;k- Hkkjr nqfu;k dk 164 ok ns'k gS† tgkWa GST ykxq fd;k x;k vkSj nks GST (SGST & CGST) ykus okyk ;g ,dek_k ns'k gS†

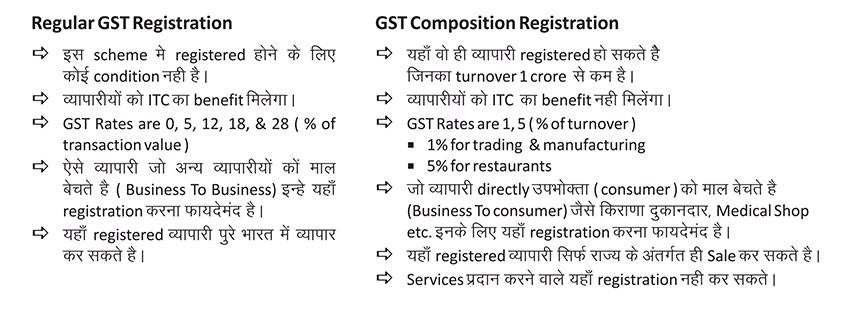

Q. fdu O;kikjh;ksa dks registration djuk tjQjh gS†

Q. Registration djus ds D;k iQk;ns gS†

Q. Composition Scheme dk option fdudks available gS†