Wealth Creation with Wise Investment

Suven Life Sciences Ltd

A probable multibagger

October 4, 2019

Success of research molecule will result in shoot up in turnover as well as profit. P/E re-rating expected. Good pipeline of research molecules and basic CRAMS business is doing good.

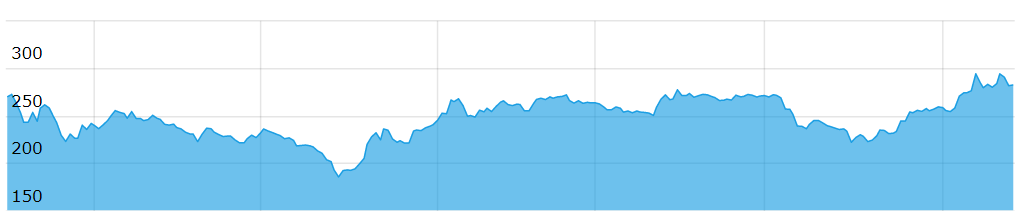

Share price on BSE for last one year

- Chances of success of SUVN-502 molecule

- Good growth is CRAMS business with high margin.

- Demerger in progress into two companies – pure research and CRAMS

- Cash rich company

- Even after setting aside 308 cr for research, fixed asset expansion and payment for Shore Pharma, company has proper plans and internally generated cash. No need to borrow.

- Good management with good track record of dividend payment.

| CMP (Rs) |

52 week High (Rs) |

52 week Low (Rs) |

Market Cap (Rs) |

| 264 |

304.75 |

183.25 |

3360.72 cr |

- Suven Life Sciences Limited is a bio-pharmaceutical company specialized in NCE-based CRAMS for global life science companies and drug discovery and developmental activities in Central Nervous System disorders.

- The Company has a 929-member team; its 429-member strong R&D team comprises of 39 PhDs and works in the research-intensive areas of analytical development, drug discovery, process R&D, and formulations development.

- Suven’s discovery assets address niche areas of cognitive impairment associated with neuro-degenerative disorders like Alzheimer’s, Attention Deficient Hyperactivity Disorder (ADHD), Huntington’s chorea, Parkinson’s, schizophrenia and sleep disorders.

- The company is a partner of choice for several global innovators like AstraZeneca, Pfizer, Bristol Myers Squibb, JnJ, Merck, Sanofi, Novartis etc.

- The company reported healthy net margin of 22.6% and gross margin of 36.54%. ROCE was down to 21.44% from 26.19%.

- PAT has grown by 47.38%, EBIDTA by 40.21%, Pre-R&D EBIDTA by 18.89% as compared to Q1 FY19. R&D cost has decreased by 18.06% as compared to Q1 FY19.

- It has maintained a healthy Operating Profit Margin(OPM) in the range of 30-38% for last 5 years.

- Last year saw decline after three straight years of growing profits due to

- A change in the product mix in the Base CRAMS segment with an increase in Phase I projects

- A fall in the volumes of Commercial CRAMS which is a high-margin business almost by 33% over the previous year due to unavailability of critical inputs. Specialty chemicals segment registered healthy volumes and compensated the shortfall in revenue from Commercial CRAMS space.

- A spike in raw material costs owing to the shortage in supply of raw materials. As a safety measure, it has secured raw materials for the first two quarters of the current year.

- R&D cost for FY19 was 60.27cr. R&D cost to revenue was 11% and R&D cost to profit was 3.3%

- The company has a strong balance sheet with a very good management team.

- Even one successful commercial molecule or movement of molecule from one phase to another can bring significant growth in company’s top line data.

- Since 2005, 750cr have been spent on discovery research. It has one of the largest pipeline of innovative assets in the CNS space – 13 molecules in all of which two (SUVN-502 and SUVN-G3031) are in Clinical Trials (Phase II), two (SUVN-D4010 and SUVN-911) are undergoing long-term toxicology studies and would be ready to enter Clinical Trials Phase II and one (SUVN-I6107) is undergoing pre-clinical and GLP toxicology studies.

- 564 patients enrolled for SUVN-502 Phase II studies across 90 clinical sites all over US. The last patient last visit has been completed in May 19 and the database lock will happen after the cleaning up of the data. Management expects database lock to take place by end of September and the data to be out by mid Oct. Suven was granted expanded access by FDA for 6 months initially and extension of another 6 months for almost 40 patients who came back after the trials. If the data is positive, there will be Phase III trials on 2500 patients. With positive data, Suven may get approximately 130 mn $ as upfront payment and some 300 mn$ over the period of trials and royalties in double-digit percentages once the drug hits the market. There are 3 more Tau proteins (competitor molecules for Alzheimer’s) in Phase II. SUVN-502 is the frontrunner.

- It has started enrolling patients for narcolepsy trials (SUVN-G3031) and the trial takes about 12 to 15 months after it has started. It is planned for 114-171 patients for 2 week duration. 12-13mn $ is the budget and market size is 2 bn$. Being a short duration trial, it should be completed by next year. One of the two competitive molecules Xyrem is addictive and is not recommended to be taken for more than 3 months. It has market size of 1.1bn $. The other – Pitolisant has market size of 600mn $.

- SUVN-911 (MDD) has cleared preclinical toxicology, Phase I clinical trials and is expected to enter Phase II. Success in phase II may result in upfront payment of 250mn $. The results should be out in another 2-3 years.

- The Company has already filed 5 ANDAs (3 own and 2 on behalf of customers)

- They are presently working on another 8-10 formulated products, which will be filed in a phased manner.

- Suven acquired 25% stake in Shore pharma for 35mn $. Shore is into development and distribution of ANDAs. It has 89 ANDAs already registered. It has 11-12 customers and 140 employees out of which 60-65 are retained.

- Company expects the new entity called Rising Holdings to make 200mn $ turnover in 1 year from the date of acquisition.

- Revenue from Rising holding will be in 3 forms:

- Suven expects 5-6 year timeframe for the revenues to start from Rising holdings.

- Though the deal size is 35mn$, Suven has paid nearly 205 cr. The remaining amount is compensated by receivables and inventories.

- The company has so far undertaken 1247 product patents, 37 product inventions, 46 process patents and 11 process inventions.

- It has initiated the construction of a brand new multi-purpose plant at Vizag at an investment of about 110 crore.

- Export contribution to total revenue – 87%

- Long term investment horizon suggested. It should give at least 15-20% returns yearly.

Financials

| Standalone (Rs. cr) |

FY19 |

FY20E |

| Sales |

687.73 |

805 |

| EBITDA |

251.32 |

305.9 |

| EBITDA Margins% |

36.54 |

38 |

| PAT |

149.93 |

187.5 |

| EPS |

11.79 |

14.73 |

| P/E |

22.39 |

17.92 |

| D/E |

0 |

0 |

Business vertical segments:

- Base CRAMS – 45% of total revenue contribution with 300cr revenue. 116 active projects with 30 new projects in CY.

- Commercial CRAMS – supply intermediates for NCE’s for 4 molecules for US & EU based clients (Women’s Health, rheumatoid arthritis and diabetes) with revenue of 80cr. The company received an order of 130cr for existing molecule and 40cr for a new molecule in women’s health segment.

- Specialty chemicals – supply intermediates (derived out of CRAMS competence) for one specialty chemical product (agrochemical) to large global conglomerate operating in pharmaceuticals & agrochemicals with 214cr revenue. It has received approval for its intermediate for another agrochemical molecule for which it initiated commercial supplies towards the close of 2018-19. Revenue increased 40% Y-o-Y.

- Contract Technical Services – has revenue of 50cr.

Base CRAMS – progressive performance

|

FY14 |

FY15 |

FY16 |

FY17 |

FY18 |

FY19 |

| Phase I |

52 |

57 |

64 |

70 |

72 |

82 |

| Phase II |

46 |

52 |

48 |

38 |

36 |

33 |

| Phase III |

1 |

1 |

1 |

2 |

1 |

1 |

| Commercial |

3 |

3 |

3 |

3 |

4 |

4 |

| Active |

102 |

113 |

116 |

113 |

113 |

120 |

Strengths:

- Suven is one of the few companies working in CNS which has highest unmet medical needs.

- Suven operates at the top of value chain of CRAMS business as it supplies intermediates to pharma innovators for their NCEs. CRAMS for NCEs is a sticky business as innovators are concerned about protection of IP and like to work with preferred vendors.

- CNS is currently the second largest and fastest growing segment in the pharma sector. According to a study, the global CNS therapeutic market is expected to reach USD 128.9 billion by 2025.

- Suven is virtually debt-free. Even after keeping apart 300cr for NCE business after demerger and CAPEX of 300cr, it still hasn’t borrowed money.

Risks:

Growth Risk: Drug discovery is a very long cycle and has very low probability of success. Developing a new medicine takes an average of 10-15 years.

Compliance Risk: Any unexpected issues from USFDA inspections or other international bodies could directly impact sales revenue.

Demerger

Suven is transforming two business verticals into two independent companies. NCE business will remain in Suven Lifesciences, while CRAMS business will get transferred into Suven Pharmaceuticals, post demerger. As there will not be any NCE based R&D expenses to be absorbed by the CRAMS business, the profitability of the CRAMS vertical would increase.

For the NCE business, a cash reserve of 300+ crore has been created, which should fund the R&D initiatives for the next 2-3 years. The segregation of business into separate companies will secure a superior valuation.

It has received NOC from the regulatory bodies (like stock exchanges) and is in the process of filing with the NCLT. Suven is hoping to complete it by Q3.

RATING MATRIX

Total return expectation (12 months)

Buy >20%

Accumulate 10-20%

Reduce 0-10%

Sell < 0%

Research Report by Aditee Amit Saoji. Aditee is Director, Investments in EasyTax Pvt Ltd. She is B.E.(Comp Sc) from VNIT, Nagpur and M.Tech. from IIT Bombay. She is NiSM certified and NSE Certified Market Professional (NCMP).

email: easytaxpvtltd@gmail.com, contact: 9922444496